Property Tax Western Ma . Here you will find helpful resources to property and various excise. Web the median massachusetts property tax is $3,511.00, with exact property tax rates varying by location and county. Web total assessed property values by property class as reported to dls by city and town boards of assessors. Web most cities and towns in massachusetts provide online access to the property records that are used to generate. Web most towns in western massachusetts with assessed home values lower than the state average have the. Web massachusetts property and excise taxes. Web data analytics and resources bureau tax rates by class data current as of 08/18/2024 Web the property tax rates are determined by each individual town and every year, towns in massachusetts publish a new property tax. New property tax rates have been set in the largest city in western massachusetts.

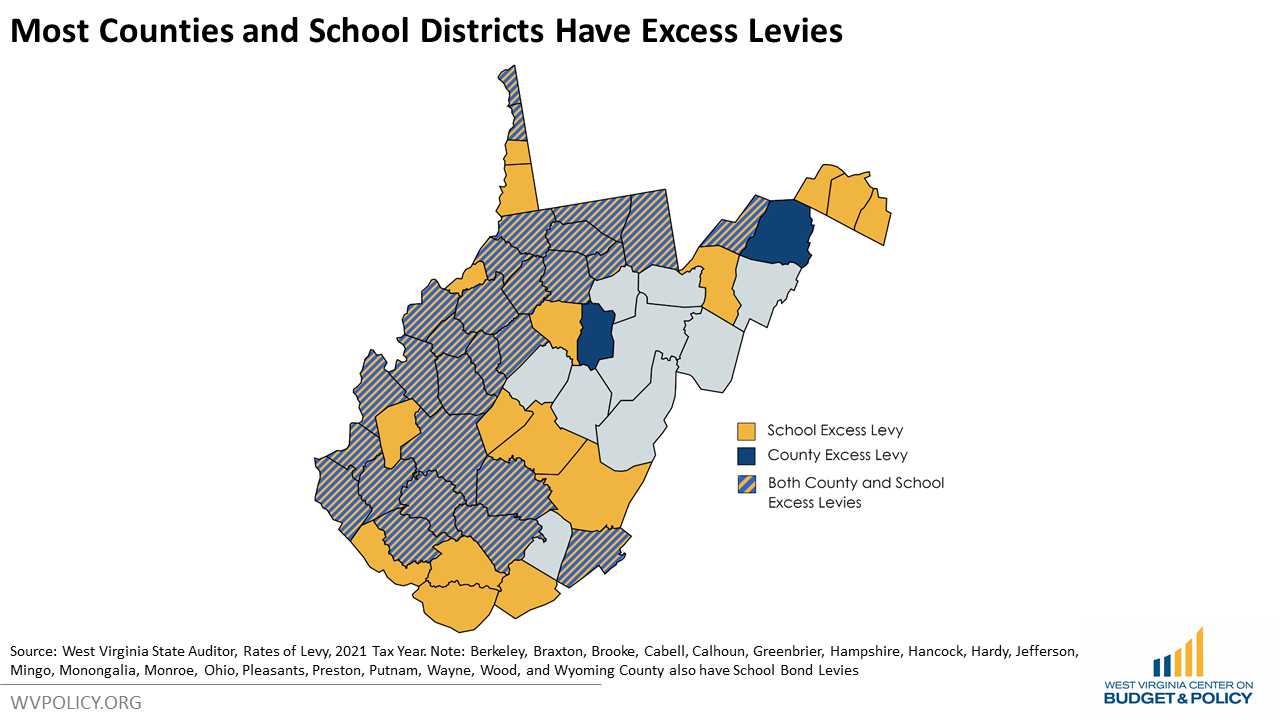

from wvpolicy.org

Web the property tax rates are determined by each individual town and every year, towns in massachusetts publish a new property tax. Web most towns in western massachusetts with assessed home values lower than the state average have the. New property tax rates have been set in the largest city in western massachusetts. Web most cities and towns in massachusetts provide online access to the property records that are used to generate. Web total assessed property values by property class as reported to dls by city and town boards of assessors. Here you will find helpful resources to property and various excise. Web the median massachusetts property tax is $3,511.00, with exact property tax rates varying by location and county. Web data analytics and resources bureau tax rates by class data current as of 08/18/2024 Web massachusetts property and excise taxes.

Proposed Property Tax Amendment Could Jeopardize Local Excess and Bond

Property Tax Western Ma Web the property tax rates are determined by each individual town and every year, towns in massachusetts publish a new property tax. New property tax rates have been set in the largest city in western massachusetts. Web total assessed property values by property class as reported to dls by city and town boards of assessors. Web massachusetts property and excise taxes. Web data analytics and resources bureau tax rates by class data current as of 08/18/2024 Web the property tax rates are determined by each individual town and every year, towns in massachusetts publish a new property tax. Web most towns in western massachusetts with assessed home values lower than the state average have the. Here you will find helpful resources to property and various excise. Web the median massachusetts property tax is $3,511.00, with exact property tax rates varying by location and county. Web most cities and towns in massachusetts provide online access to the property records that are used to generate.

From suburbs101.com

Massachusetts Property Tax Rates 2023 (Town by Town List with Property Tax Western Ma Web the median massachusetts property tax is $3,511.00, with exact property tax rates varying by location and county. Web the property tax rates are determined by each individual town and every year, towns in massachusetts publish a new property tax. Here you will find helpful resources to property and various excise. Web most cities and towns in massachusetts provide online. Property Tax Western Ma.

From taxfoundation.org

State & Local Property Tax Collections per Capita Tax Foundation Property Tax Western Ma Web the median massachusetts property tax is $3,511.00, with exact property tax rates varying by location and county. Web total assessed property values by property class as reported to dls by city and town boards of assessors. Web massachusetts property and excise taxes. Web the property tax rates are determined by each individual town and every year, towns in massachusetts. Property Tax Western Ma.

From omaha.com

The cities with the highest (and lowest) property taxes Property Tax Western Ma New property tax rates have been set in the largest city in western massachusetts. Web massachusetts property and excise taxes. Web total assessed property values by property class as reported to dls by city and town boards of assessors. Web the median massachusetts property tax is $3,511.00, with exact property tax rates varying by location and county. Web data analytics. Property Tax Western Ma.

From wvgis.wvu.edu

wvgis.wvu.edu /data/statusGraphics/Tax Maps/ Property Tax Western Ma Web the median massachusetts property tax is $3,511.00, with exact property tax rates varying by location and county. Web total assessed property values by property class as reported to dls by city and town boards of assessors. Web most towns in western massachusetts with assessed home values lower than the state average have the. New property tax rates have been. Property Tax Western Ma.

From deborahsilvermusic.com

Wirt County Sheriff Department, 48 OFF Property Tax Western Ma Web the median massachusetts property tax is $3,511.00, with exact property tax rates varying by location and county. Web total assessed property values by property class as reported to dls by city and town boards of assessors. Web most cities and towns in massachusetts provide online access to the property records that are used to generate. Web data analytics and. Property Tax Western Ma.

From weststpaulreader.com

Property Tax Explainer 10 Insights Into West St. Paul’s Property Taxes Property Tax Western Ma Web most towns in western massachusetts with assessed home values lower than the state average have the. Here you will find helpful resources to property and various excise. Web the median massachusetts property tax is $3,511.00, with exact property tax rates varying by location and county. Web total assessed property values by property class as reported to dls by city. Property Tax Western Ma.

From www.johnlocke.org

Twentyfour Counties Due for Property Tax Reassessments This Year Property Tax Western Ma Web most towns in western massachusetts with assessed home values lower than the state average have the. Web data analytics and resources bureau tax rates by class data current as of 08/18/2024 Web the property tax rates are determined by each individual town and every year, towns in massachusetts publish a new property tax. Web most cities and towns in. Property Tax Western Ma.

From massbaymovers.com

Norfolk County, MA Property Taxes 💸 2024 Ultimate Guide & What You Property Tax Western Ma Web the property tax rates are determined by each individual town and every year, towns in massachusetts publish a new property tax. New property tax rates have been set in the largest city in western massachusetts. Here you will find helpful resources to property and various excise. Web most towns in western massachusetts with assessed home values lower than the. Property Tax Western Ma.

From www.formsbank.com

Form Wv/mptac1 Manufacturing Property Tax Adjustment Credit Property Tax Western Ma Here you will find helpful resources to property and various excise. Web total assessed property values by property class as reported to dls by city and town boards of assessors. Web the median massachusetts property tax is $3,511.00, with exact property tax rates varying by location and county. Web massachusetts property and excise taxes. Web data analytics and resources bureau. Property Tax Western Ma.

From www.chicagobusiness.com

Chicago property taxes rise nearly 7 in 2023 tax year Crain's Juice Property Tax Western Ma New property tax rates have been set in the largest city in western massachusetts. Web most towns in western massachusetts with assessed home values lower than the state average have the. Web most cities and towns in massachusetts provide online access to the property records that are used to generate. Web the property tax rates are determined by each individual. Property Tax Western Ma.

From wvpolicy.org

Proposed Property Tax Amendment Could Jeopardize Local Excess and Bond Property Tax Western Ma Web total assessed property values by property class as reported to dls by city and town boards of assessors. Web the median massachusetts property tax is $3,511.00, with exact property tax rates varying by location and county. Web the property tax rates are determined by each individual town and every year, towns in massachusetts publish a new property tax. Web. Property Tax Western Ma.

From rethority.com

Property Tax by County & Property Tax Calculator REthority Property Tax Western Ma Web data analytics and resources bureau tax rates by class data current as of 08/18/2024 Web the median massachusetts property tax is $3,511.00, with exact property tax rates varying by location and county. Here you will find helpful resources to property and various excise. Web most towns in western massachusetts with assessed home values lower than the state average have. Property Tax Western Ma.

From northofbostonlifestyleguide.com

Massachusetts Property Tax Rates NORTH OF BOSTON LIFESTYLE GUIDE™ Property Tax Western Ma Web data analytics and resources bureau tax rates by class data current as of 08/18/2024 Web most towns in western massachusetts with assessed home values lower than the state average have the. Web massachusetts property and excise taxes. Here you will find helpful resources to property and various excise. Web total assessed property values by property class as reported to. Property Tax Western Ma.

From www.illinoispolicy.org

The Chicago squeeze Property taxes, fees and over 30 individual taxes Property Tax Western Ma Web most cities and towns in massachusetts provide online access to the property records that are used to generate. Web the median massachusetts property tax is $3,511.00, with exact property tax rates varying by location and county. Web the property tax rates are determined by each individual town and every year, towns in massachusetts publish a new property tax. New. Property Tax Western Ma.

From www.caliper.com

Maptitude Map Massachusetts Property Tax Override Votes Property Tax Western Ma Web massachusetts property and excise taxes. New property tax rates have been set in the largest city in western massachusetts. Web most cities and towns in massachusetts provide online access to the property records that are used to generate. Web data analytics and resources bureau tax rates by class data current as of 08/18/2024 Web the property tax rates are. Property Tax Western Ma.

From www.scotsmanguide.com

Property tax increases put pressure on homeownership Scotsman Guide Property Tax Western Ma Web data analytics and resources bureau tax rates by class data current as of 08/18/2024 Web massachusetts property and excise taxes. New property tax rates have been set in the largest city in western massachusetts. Web the property tax rates are determined by each individual town and every year, towns in massachusetts publish a new property tax. Web most cities. Property Tax Western Ma.

From www.taxuni.com

Massachusetts Property Tax 2023 2024 Property Tax Western Ma New property tax rates have been set in the largest city in western massachusetts. Web most cities and towns in massachusetts provide online access to the property records that are used to generate. Web most towns in western massachusetts with assessed home values lower than the state average have the. Web data analytics and resources bureau tax rates by class. Property Tax Western Ma.

From www.homeadvisor.com

Property Taxes By State Mapping Out Increases Over Time HomeAdvisor Property Tax Western Ma Web total assessed property values by property class as reported to dls by city and town boards of assessors. New property tax rates have been set in the largest city in western massachusetts. Web the median massachusetts property tax is $3,511.00, with exact property tax rates varying by location and county. Web the property tax rates are determined by each. Property Tax Western Ma.